Introduction: What Does Judaism Say About Investing?

In today’s fast-paced financial world, modern investing meets ancient wisdom. Conversations about stocks, real estate, cryptocurrency, and emerging markets often dominate headlines. Yet beneath the surface of Wall Street and Silicon Valley, there exists a timeless and powerful guide to financial decision-making rooted not in spreadsheets, but in the Torah and Talmud. These enduring Jewish investing principles offer not only practical strategies for managing money but also a deeply ethical, spiritually grounded approach to wealth-building.

It’s a common misconception that religion and finance operate in separate realms. Many believe religious life is confined to prayer, morality, and tradition, while investing revolves around markets, math, and risk management. Judaism, however, sees no such divide. The Torah addresses all aspects of human life—including business, wealth, and financial stewardship—with clear intention. In Jewish thought, the financial world is not merely transactional; it is a sacred space where values meet action, and wealth is seen as a means to do good in the world.

From the Talmud to modern rabbinic literature, we find detailed discussions on fair trade, diversification, inheritance, charity, and economic responsibility. For example, in Bava Metzia 42a, the Sages provide a model of asset allocation that mirrors today’s diversification strategies: “A person should always divide his money into three—one-third in land, one-third in merchandise, and one-third kept in reserve.” This wisdom emphasizes balance, prudence, and thoughtful risk management, principles that align closely with today’s best practices in financial planning.

About This Article

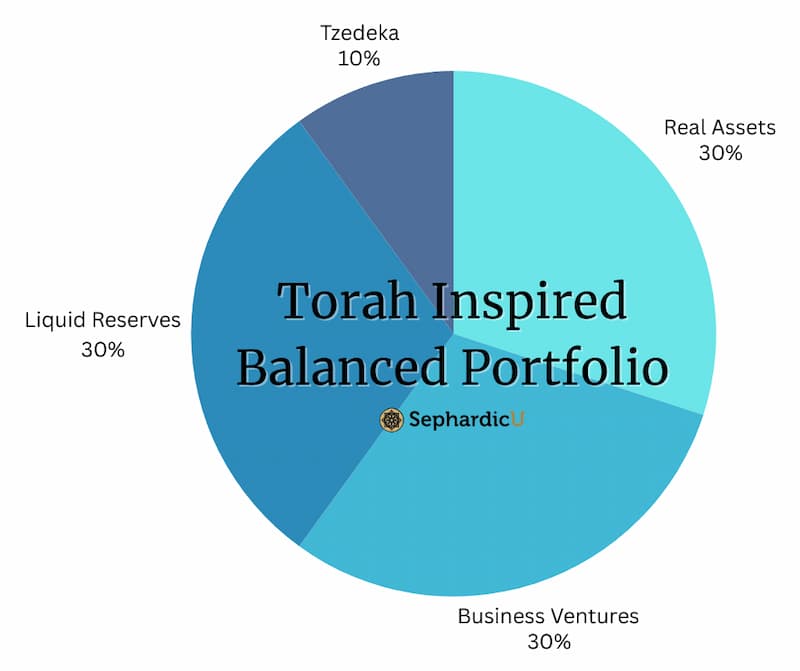

This article explores how Jewish investing principles intersect with modern financial strategies. You will discover how Torah values can shape your investment decisions—from asset allocation to charitable giving, from ethical investing to long-term planning. We’ll compare ancient frameworks with contemporary models, offer a sample Torah-inspired portfolio, and share insights from Jewish sages and contemporary thought leaders on the ethical approach to wealth.

Whether you’re a beginner seeking to align your financial goals with your faith or an experienced investor looking for deeper purpose in your portfolio, Jewish investing principles will provide you with a blueprint for growth that is ethical, balanced, and spiritually meaningful. In Judaism, wealth-building is not just about maximizing returns—it’s about cultivating responsibility, creating lasting impact, and leaving a legacy of blessing.

Wisdom from Chazal and Rabbanim

“The highest level of tzedakah is enabling a person to become self-sufficient.”

RambamMishneh Torah

“Wisdom is a shelter as money is a shelter, but the advantage of knowledge is this: wisdom preserves those who have it.”

Kohelet 7:12

“Know what is above you: an eye that sees, an ear that hears, and all your deeds are written in a book.”

Pirkei Avot 2:1

“Wealth is not what you own, but what you share.”

Rabbi Jonathan Sacks zt”l

1. The Jewish View of Wealth: A Divine Tool for Purposeful Living

In Judaism, wealth is neither inherently good nor bad—it’s a tool. Like any tool, it can be used to create, destroy, uplift, or oppress. The Jewish view of wealth, as laid out in the Torah, acknowledges both its blessings and its tests. Jewish investing principles emphasize that financial success is never merely self-made; it is a divine opportunity that comes with spiritual responsibility. Understanding this principle is key to making wise, ethical financial decisions.

The Torah teaches us in Devarim (Deuteronomy) 8:18, “Remember the Lord your God, for it is He who gives you the power to acquire wealth.” This verse encapsulates the Jewish perspective: wealth is not a symbol of superiority, nor is it a divine favor granted without purpose. Rather, wealth is seen as a test—a nisayon—a challenge that measures how we use the resources entrusted to us. When Hashem grants material abundance, it comes with the responsibility to use it wisely, ethically, and generously.

Chazal (the Sages)

Jewish sages (Chazal) emphasize that financial success is secondary to the character and ethical behavior exhibited through wealth. The focus is on integrity in business dealings, generosity in charity, and using success to uplift others. This perspective turns the accumulation of wealth into a spiritual mission rather than a mere pursuit of profit.

As modern-day investors seek to build portfolios, this ancient principle remains deeply relevant. Jewish investing principles teach that financial planning should not just be about building personal security. It’s also about using wealth to make a broader impact—on your family, community, and the world. Jewish investors are tasked with building not just wealth, but also opportunity for others to thrive.

This understanding also shapes how we approach financial strategy. For instance, wealth-building isn’t about hoarding assets but about allocating resources in ways that lead to positive societal change. From this perspective, the idea of Jewish investing principles transforms financial planning into a tool for tzedakah (charity), tikkun olam (repairing the world), and ensuring future generations are secure.

In short, investing, according to Jewish thought, is not just about accumulating assets. It’s about spiritual stewardship—using your resources to fulfill a mission that serves both your personal needs and the greater good. When we understand that wealth is a tool from God, entrusted to us for a specific purpose, we can approach investing not only with strategy, but also with deep spiritual intent.

2. Diversification: Ancient Strategy, Modern Portfolio Theory

One of the foundational principles in modern investing is diversification—spreading investments across various asset classes to reduce risk and maximize returns. Interestingly, this strategy is not a new concept; it has deep roots in Jewish tradition. Long before the development of modern financial markets, the Talmud provided practical guidance on wealth allocation to manage risk effectively. Today, this ancient Jewish strategy is still relevant, directly influencing contemporary Jewish investing principles.

In Bava Metzia 42a, the Talmud instructs: “A person should always divide his money into three—one-third in land, one-third in merchandise, and one-third kept in reserve.” This advice mirrors modern diversification strategies, urging investors to spread their wealth across different asset classes to protect against risk. The Talmud’s division of wealth—land, business, and cash—can be directly translated into today’s key asset classes: real estate (land), equities and business ventures (merchandise), and cash reserves (liquid assets). These categories form the foundation of a diversified portfolio, offering both long-term growth potential and liquidity while reducing the risk associated with any one asset.

The Importance of Diversification

The importance of diversification is further underscored in Ecclesiastes 11:2, where King Solomon advises: “Give a portion to seven, and even to eight, for you do not know what disaster may come upon the land.” This principle emphasizes spreading investments across multiple assets to mitigate risk. For modern investors, this might involve diversifying across stocks, bonds, real estate, and cash equivalents. It could also mean broadening investments geographically or across different sectors, such as technology, healthcare, and sustainable energy, to safeguard against unpredictable market fluctuations.

For example, Vanguard’s Total Market Index Fund (VTI) provides an ideal modern parallel to the Talmudic strategy. VTI offers exposure to a broad range of U.S. stocks, mirroring the ancient practice of distributing investments across various asset types. By holding a well-rounded portfolio that includes diversified assets like real estate (land), equities (business ventures), and liquid assets (cash), investors can create a more resilient financial position—especially during volatile economic times.

Jewish wisdom on diversification also includes an ethical component. Just as today’s investors are encouraged to consider socially responsible investing (SRI), environmental, social, and governance (ESG) factors, Judaism urges a thoughtful approach to where and how wealth is allocated. This aligns with values of fairness, charity, and justice, ensuring that investments contribute positively to society.

Ultimately, the Talmudic approach to diversification is more than just practical advice; it offers a framework for building a strong, sustainable portfolio. By applying these ancient principles, investors today can create wealth that is not only financially sound but also aligned with Jewish values of responsibility, sustainability, and ethical impact. Whether it’s mitigating risk or positioning for future growth, the timeless wisdom of Jewish investing principles continues to guide investors toward a balanced, prosperous future.

Modern Portfolio vs. Jewish Investing (Talmudic Portfolio)

| Asset Type | Modern Portfolio | Talmudic Portfolio (Bava Metzia 42a) |

|---|---|---|

| Real Estate / Property | Real estate investments, REITs | “One-third in land” – stable, tangible assets |

| Business/Equity | Stocks, private equity, small business | “One-third in merchandise” – productive ventures |

| Cash / Liquidity | Savings, money market, short-term bonds | “One-third in cash” – liquid, accessible capital |

| Ethical Consideration | ESG (Environmental, Social, Governance) | Halachic values – no profiting from wrongdoing |

| Philanthropy | Optional, tax-motivated | Mandatory ma’aser (10% tithe), spiritual ROI |

| Time Horizon | Often growth-focused, retirement goals | Balanced: present, future, and eternal legacy |

3. Ethical Jewish Investing: Halacha and Values-Based Wealth

In a time when investors increasingly evaluate their portfolios through lenses like ESG (Environmental, Social, and Governance) or SRI (Socially Responsible Investing), Judaism offers a powerful, ancient framework that’s long aligned profit with purpose. Ethical investing is not a trend—it’s a Torah principle. The foundation of Jewish investing principles is not just about making money, but about making money right.

Halacha (Jewish law) clearly outlines the moral obligations of wealth creation. Leviticus 19:14 teaches, “You shall not place a stumbling block before the blind.” While this verse is often interpreted literally, the rabbis expanded its meaning: one must not cause others to err, especially in financial matters. Known as Lifnei Iver, this principle prohibits profiting from deceitful, harmful, or exploitative enterprises. In today’s terms, it’s a spiritual veto against investing in companies that rely on unfair labor, pollute the environment, promote addictive products, or undermine the wellbeing of communities.

Judaism does more than caution investors—it compels them to do good. The value of tikkun olam (repairing the world) is not a poetic suggestion; it’s a practical imperative. This ethos transforms your investment portfolio into a platform for change. Supporting clean energy companies, education-focused startups, or businesses that empower marginalized groups isn’t just nice—it’s aligned with centuries of Jewish ethical reasoning. Every dollar invested becomes a vote for the kind of world you want to build.

The Importance of Diversification

Modern investing offers tools that naturally align with this mindset. SRI portfolios often screen out industries like tobacco, firearms, or fossil fuels and prioritize sectors such as renewable energy, public health, and social justice. ESG investing, which analyzes companies based on environmental impact, labor relations, and transparent governance, closely mirrors halachic concerns about fairness, stewardship, and accountability.

For example, a Jewish investor might screen out companies with questionable environmental records and instead allocate funds to green energy ETFs or mutual funds like iShares Global Clean Energy ETF (ICLN). Or they might invest in community development financial institutions (CDFIs), which provide capital to underserved populations—reflecting the mitzvah of empowering the economically vulnerable.

Even within mainstream investing, there’s room for Jewish values. Take a core holding like Vanguard’s ESG U.S. Stock ETF (ESGV)—it filters out companies that fail to meet basic ethical thresholds while offering broad market exposure. This enables investors to stay diversified while still upholding Lifnei Iver and tikkun olam.

Ethical investing also means being mindful of how returns are used. Jewish law encourages giving a portion of one’s earnings to tzedakah (charity), ideally ten percent. The goal isn’t just to accumulate wealth—but to use that wealth as a force for good.

Ultimately, ethical investing through the lens of Judaism is about intention and alignment. When your financial choices reflect your spiritual values, your portfolio becomes more than a collection of assets—it becomes a living expression of Torah values. By weaving Halacha, social responsibility, and financial intelligence into our investing strategies, we fulfill the deeper mission of Jewish investing principles: to grow wealth with wisdom, impact, and integrity.

4. Risk Management and Responsible Hishtadlut

In the intricate world of finance, managing risk is not just a best practice—it’s a moral imperative. Judaism has long taught that hishtadlut, or human effort, must be tempered with wisdom and restraint. Reckless risk-taking not only jeopardizes one’s finances but also violates the Torah’s deeper call for responsible stewardship. In both ancient texts and modern markets, Jewish investing principles emphasize a delicate balance between strategic effort and bitachon—trust in God.

The Torah never glorifies blind risk. Instead, it calls for thoughtful action. Proverbs 21:5 warns, “The plans of the diligent lead to profit, but hasty action leads to poverty.” This timeless insight urges investors to be methodical, diligent, and future-minded. In today’s terms, this means conducting due diligence, diversifying one’s portfolio, and resisting the urge to chase fads or speculate impulsively. A Torah-guided investor is not a gambler—they are a planner.

Responsible hishtadlut means approaching investing as a form of avodah—sacred work. This includes assessing risk carefully, avoiding investments that hinge solely on chance, and preparing for downturns with humility. The Talmud (Bava Metzia 42a) even advises diversification as a risk mitigation strategy: “A person should always divide his money into three parts: one third in land, one third in merchandise, and one third in reserve.” While modern investment vehicles have evolved, the core principle of spreading risk remains deeply relevant.

The Importance of Bitachon

At the same time, bitachon—trust in Hashem—grounds the Jewish investor in spiritual clarity. It is not a passive hope, but an active mindset that allows one to engage with the market without becoming consumed by anxiety or greed. Bitachon reminds us that success is not solely the result of clever timing or perfect stock picks. It is ultimately God who blesses our efforts, and our job is to act wisely while remaining spiritually anchored.

This duality—of effort and trust—is what makes Jewish investing uniquely balanced. One neither leaves everything to chance nor assumes total control. Instead, the Jewish investor operates in the tension between doing their part and letting go of the rest. This concept is particularly helpful during market volatility, when panic can lead to irrational decisions. Bitachon brings emotional resilience, while hishtadlut guides rational action.

In modern financial planning, this principle manifests through:

- Thoughtful asset allocation based on long-term goals, not short-term hype

- Emergency funds that provide stability during economic downturns

- Insurance and estate planning that secure the future for one’s family

- Avoidance of over-leveraging or speculative ventures that lack fundamental value

The Torah’s wisdom teaches that every financial decision is part of a larger ethical and spiritual framework. By integrating responsible hishtadlut with deep bitachon, investors can pursue financial growth with confidence and humility. They understand that the stock market may fluctuate—but their values remain steady.

Ultimately, risk management according to Jewish investing principles is not about avoiding all uncertainty. It’s about engaging the world with wisdom, preparation, and faith. When these values align, one’s wealth becomes a vessel not only for material success but for spiritual meaning—reflecting a life where effort, ethics, and emunah walk hand in hand.

5. Tzedakah: The Spiritual Allocation

In the Jewish worldview, wealth is never solely a private asset—it is a sacred trust. It is given to us not just to enjoy, but to share, to uplift, and to sanctify. Tzedakah, often translated as “charity,” is far more than benevolence; it is justice, righteousness, and spiritual accounting. In a Torah-centered life, giving is not optional—it is built into the architecture of ethical financial living.

The Torah instructs us in Deuteronomy 14:22–29 to set aside a tenth of our produce and income, a practice known as ma’aser, literally “a tenth.” This ancient obligation has remained a cornerstone of Jewish financial ethics for millennia. Ma’aser is not viewed as a loss, but as a spiritual investment—one that yields returns not only in the lives of those we help, but in the soul of the giver. In fact, the Talmud (Taanit 9a) boldly states that giving ma’aser is the only mitzvah for which we are permitted to “test” God—inviting divine blessing as a result of our generosity.

In Proverbs 19:17, King Solomon declares, “One who is gracious to the poor lends to Hashem, and He will repay him for his good deed.” This verse encapsulates the radical idea that tzedakah is not a simple act of kindness—it is a loan to God Himself. The return on such a loan is immeasurable, both in spiritual merit and in divine favor. In this light, tzedakah becomes the most enduring kind of investment: one that transcends time and space, echoing into the World to Come.

Tzedakah as Part of a Portfolio

For the Jewish investor, tzedakah is part of the portfolio. Just as one diversifies assets to build financial stability, one must allocate resources to tzedakah to build spiritual integrity. In fact, many halachic authorities teach that giving away less than 10% of income falls short of what is expected from a conscientious Jew. The ideal—ma’aser kesafim—is a disciplined practice that transforms giving into a regular, integral aspect of wealth management.

But giving in Judaism is not merely about the amount—it’s about how we give. Rambam (Maimonides), in his famed Eight Levels of Tzedakah, emphasizes that the highest form of giving is helping someone become self-sufficient. Just as wise investors seek sustainable returns, wise givers seek sustainable change. Moreover, the Torah ideal of giving with discretion—anonymously, and with dignity to the recipient—reflects the deeper value of humility in giving. It’s not about the donor’s ego—it’s about the recipient’s restoration.

The Zohar

Tzedakah also serves a mystical purpose. The Zohar teaches that giving tzedakah not only protects one from harm but sweetens divine judgment. The act of giving becomes a form of tikkun—a rectification of the soul and of the world. In Kabbalistic terms, wealth is a divine energy, and when used properly, it channels blessing and compassion into the universe.

Incorporating tzedakah into your financial life reframes how you view wealth. Your bank account becomes not just a personal ledger, but a spiritual conduit. Your giving becomes not just a tax write-off, but a statement of faith, identity, and purpose. You are no longer just managing assets—you are building eternity.

For the Jewish investor, then, tzedakah is not the cherry on top of a successful portfolio—it is the foundation. It reminds us that financial success is meaningless unless it is aligned with higher values. Giving regularly and generously is a profound way to express gratitude, channel blessing, and ensure that one’s material success becomes a catalyst for moral and spiritual impact.

6. Intergenerational Wealth and Legacy

In the Jewish tradition, wealth is not seen as an end in itself, but as a bridge between generations—a sacred inheritance that encompasses not just financial resources, but values, wisdom, and moral purpose. The Torah teaches us that our material blessings carry a responsibility that extends far beyond our own lives. “A good man leaves an inheritance to his children’s children” (Proverbs 13:22). This powerful verse encapsulates a foundational concept in Jewish financial ethics: wealth must be built with legacy in mind.

While modern financial discourse often centers on short-term gains, the Torah urges us to consider the long arc of our impact. Building wealth is not merely about provision for today—it is about establishing enduring frameworks of stability, righteousness, and responsibility that will shape tomorrow. Our financial decisions, therefore, must reflect the foresight of the generations that will come after us.

The Importance of Diversification

This Torah-oriented approach aligns remarkably with the philosophy of some of the world’s most successful investors. Warren Buffett, the “Oracle of Omaha,” famously said, “Our favorite holding period is forever.” His investment strategy is rooted in patience, long-term thinking, and building durable institutions—an outlook that echoes Jewish values of continuity and purpose. Buffett has long spoken about the importance of passing down not just wealth, but a sense of mission. In his 2013 letter to shareholders, he wrote, “The most important thing I can do for my children is to make sure they have a sense of purpose.” This mirrors the Torah’s broader view of inheritance: not simply transferring assets, but transmitting identity.

Bill Ackman, another prominent investor, shares a similar perspective. His aspiration to “build a lasting institution” and use wealth for societal benefit resonates deeply with the Jewish imperative of tikkun olam—repairing the world. Ackman’s emphasis on stewardship and generational responsibility reflects a profound truth: wealth, when wisely managed, can become a vessel for enduring impact. It is not merely about how much we accumulate, but about how well we equip the next generation to use it with integrity and vision.

Halacha (Jewish Law)

In halacha (Jewish law), inheritance is more than a legal mechanism—it is a moral obligation. Jewish inheritance laws are designed to ensure fairness, continuity, and alignment with divine principles. And yet, they also emphasize that true inheritance goes beyond monetary value. A Jewish will should transmit not just funds, but foundations: stories, values, life lessons, blessings. Many traditional wills even include an ethical will—a heartfelt letter to children and grandchildren expressing hopes, dreams, and guidance for how to live a good and holy life.

This dual inheritance—of wealth and wisdom—embodies the Jewish concept of nachalah, or legacy. We are not simply passing down assets; we are entrusting the next generation with the mission to continue a life of purpose, compassion, and holiness. It is our responsibility to ensure they are prepared for that role, not only financially but spiritually.

For the Jewish investor, then, building intergenerational wealth is not merely about asset allocation—it is about soul cultivation. It is about investing in education, instilling values, and modeling financial discipline anchored in Torah ethics. It means setting up systems—through estate planning, charitable foundations, and family engagement—that ensure wealth serves its highest purpose.

As we invest with an eye toward the future, we must ask ourselves: What will my children inherit from me beyond money? Will they inherit a vision? A commitment to righteousness? A legacy of giving? When our financial decisions are guided by such questions, we are not just managing wealth—we are building eternity.

7. The Sabbath Principle: Balancing Wealth with Rest

In a culture that often idolizes constant productivity, the Jewish view of wealth challenges the very foundation of hustle culture. According to Torah wisdom, true wealth is not only measured in assets and achievements—but also in peace of mind, spiritual clarity, and time well spent. At the center of this philosophy stands Shabbat, the crown jewel of Jewish time, a weekly sanctuary in time that invites us to pause, reflect, and reconnect.

The Torah makes this principle explicit: “Six days you shall do your work, but on the seventh day you shall rest” (Exodus 23:12). Rest is not framed as a break from productivity—it is an integral part of the cycle of meaningful, balanced living. Shabbat teaches us that wealth is not the ultimate purpose of life; it is a tool that allows us to honor Hashem, nurture our relationships, and focus on what truly matters. Without rest, there is no sustainability. Without purpose, wealth becomes hollow.

Jewish tradition elevates Shabbat beyond mere rest—it is oneg, a delight, a weekly taste of the World to Come. It’s a day when we put aside work emails, financial reports, and business calls to be fully present with our families, communities, and our Creator. In this way, Shabbat becomes an act of spiritual defiance against the relentless pressures of the marketplace.

A Day of Rest

Remarkably, many Jewish business leaders have modeled this ancient wisdom in their modern success. Sheldon Adelson, the late philanthropist and casino magnate, built a global empire—yet he never compromised on Shabbat. “I always tried to live my life according to Jewish values,” he once said. “For me, Shabbat is sacred… a time to step back, reflect, and renew my spirit.” Even amid high-stakes deals and international travel, Adelson demonstrated that observing Shabbat wasn’t a hindrance to success—it was part of its foundation.

Others, like Mark Cuban, may not practice Shabbat traditionally, but embrace its underlying principle. “If you’re not taking time for yourself, you can’t be your best self,” Cuban remarked. “I take my weekends off… I can’t imagine not having time to reset and recharge.” His words resonate with a core truth: rest fuels innovation, perspective, and resilience.

Joseph Sitt, founder of Thor Equities and a deeply observant Jew, underscores this mindset. “There’s no question that my faith shapes how I approach my business and personal life. Shabbat is my time to disconnect,” he shared. “I shut down my phone and focus on family. It’s this time of rest that helps me be more productive when I’m working.” For Sitt, Shabbat isn’t a break from productivity—it’s the secret behind it.

A Blueprint for Success

This ancient rhythm—six days of labor, one day of rest—isn’t just a religious commandment. It’s a divine blueprint for sustainable success. By building in a regular pause, we recalibrate. We return to our work with sharper clarity, deeper gratitude, and renewed energy. Shabbat is a spiritual investment with immense return: in health, in focus, and in meaning.

In today’s high-octane economy, where being “always on” is often seen as a virtue, the Sabbath principle reminds us that restraint is just as powerful as ambition. To step back is not to fall behind—it is to leap forward with intention. It is to trust that the world continues even when we pause, and that our worth is not defined solely by output.

True wealth, in the Torah’s eyes, is a balanced life—rich in spirit, rooted in values, and mindful of time. By embracing the Sabbath principle, Jewish business leaders show that one can be both ambitious and anchored, driven yet devout. Shabbat is not just a day off; it is a declaration of priorities. It is the space in which we remember who we are and why we do what we do.

Let Shabbat be the rhythm that grounds your pursuit of success. In disconnecting from the world, we reconnect with what truly matters.

10 Torah Guidelines for Smart Investing

- Diversify your portfolio – Bava Metzia 42a

- Avoid unethical industries – Lifnei Iver

- Allocate 10% to tzedakah – Ma’aser

- Invest with intent, not impulse – Hishtadlut

- Maintain liquidity for emergencies

- Make wealth a means, not an identity

- Review and rebalance periodically

- Teach your children fiscal wisdom

- Plan your legacy – Tov yanchil banim

- Sanctify rest and work – Observe Shabbat

Conclusion: Jewish Investing with Purpose, Living with Balance

In the pursuit of financial success, the Torah offers a framework that transcends the mere accumulation of assets. Jewish wisdom invites us to view wealth not as an end, but as a means—a powerful tool to live with purpose, serve our communities, and honor our relationship with Hashem. True success, in this light, is measured not just by what we earn, but by how we live, give, and grow.

Throughout this article, we’ve explored the rich tapestry of Torah teachings on money, investing, and prosperity. We’ve seen that wealth, when approached with humility and wisdom, becomes a sacred trust—an opportunity to fulfill our mission in life. The Torah calls us to balance diligence with faith, ambition with ethics, and growth with gratitude. Whether through the principle of diversification, long-term planning, ethical investing, or sabbatical rest, each Torah-guided financial value contributes to a holistic, meaningful approach to wealth-building.

Jewish Entrepreneurs

Modern Jewish entrepreneurs—from Sheldon Adelson to Joseph Sitt—illustrate that these ancient principles are not only relevant but essential in today’s fast-paced world. They demonstrate that it’s possible to build empires while remaining grounded in tradition, family, and faith. Even figures like Warren Buffett, who is not Jewish, reflect values that mirror Torah insights: patience, discipline, legacy, and philanthropy.

Central to this framework is tzedakah—the mitzvah of giving. The Torah teaches that giving is not just charity; it is justice. It’s not just generosity; it’s responsibility. When we dedicate a portion of our income to those in need, we uplift others and elevate ourselves. We transform money into meaning and success into significance. In doing so, we participate in the ongoing work of tikkun olam—repairing the world.

The Rhythm of Rest

Equally vital is the rhythm of rest. Shabbat, our weekly retreat from the noise of commerce and competition, is a divine gift—a time to recalibrate our priorities and reconnect with our higher selves. In honoring Shabbat, we affirm that we are more than our professions, more than our net worth. We are souls with purpose. Jews are families with values. We are partners with the Divine in the work of creation.

Ultimately, the Torah teaches us that the goal of financial achievement is not materialism, but meaning. Not greed, but growth. Not status, but service. When we invest with wisdom, give with compassion, and live with balance, we create a legacy that endures beyond markets and generations. We become stewards of blessing—living testaments to the power of faith, values, and vision.

So as you chart your own financial journey, may you be guided by the enduring light of Torah. Let your wealth be more than numbers—let it be a reflection of who you are and the good you bring into the world. Because in the end, wealth is not defined by what we possess—but by how we use it to bless others and fulfill our higher calling.

Is Your Portfolio Aligned With Jewish Values?

Inspired to align your values with your actions? A donation to Sephardic U helps us empower value-driven Jewish learning and leadership.

Support Value-Aligned Learning

Your donation helps us expand meaningful Jewish education and inspire ethical leadership rooted in Torah values.

Weekday Torah reading – Parashat Chukat (Sephardic style)